Your smile speaks

Know More About Insta Savings Account

It’s time to experience the delight of opening a savings account instantly. Grow your savings at an attractive interest rate of upto 7.75%* p.a. with monthly interest credit. Enjoy discounts and offers when paying from your debit card, along with a host of other benefits.

More Reasons To Choose Insta Savings Account

Minium Balance Requirement

Nil

Interest Rate

Upto 7.75%* p.a. with monthly interest credit

Online Banking

Fund transfers, bill payments, debit card payments and more

Safe & Secure Transactions

Fast, convenient, and secure banking experience

Rates & Charges

Average monthly balance

Nil

Minimum balance requirement

Nil

Minimum initial payment amount

₹10,000

Eligibility And Documents

Who can apply?

Any individual above 18 years of age with no prior relationship with Suryoday SFB

What are the documents required?

Open Account Instantly And Get A Voucher

Fill in your personal details

Authenticate your Aadhaar

Enjoy a voucher on account opening

Terms and conditions

- Taxes as applicable will be levied on the charges.

- Earn 2.50%* p.a. on balance up to and including ₹1 Lakh.

- 4.00%* p.a. on balance over ₹1 Lakh up to and including ₹5 Lakh.

- 7.25%* p.a. on balance over ₹5 Lakh up to and including ₹10 Lakh.

- 7.50%* p.a. on balance over ₹10 Lakh up to and including ₹2 Crore.

- 7.50%* on balance over ₹2 Crore up to and including ₹5 Crore.

- 7.75%* p.a. on balance over ��₹5 Crore up to and including ₹25 Crore.

- 7.25%* p.a. on balance over ₹25 Crore.

- Applicable interest will be calculated on the incremental amount for the slabs. Rates are subject to change from time to time at the sole discretion of Suryoday Small Finance Bank Ltd.

*T&C Apply.

- Insta Savings Account opening is available only for new to bank customer.

- Initial Payment requirement for opening this account will be ₹10000 and can be completed only through UPI.

- Cheque book facility will be available only after completing the full KYC.

- If the account is not funded within 30 days; the bank will close the account on 31st day.

- Vouchers will be issued only after the successful funding of ₹10000

- Physical debit card would be issued for the accounts opened in this product.

- Customer with Aadhar or current address belonging to restricted area (J&K, Bihar, Jharkhand, Himachal Pradesh, West Bengal, All Northeastern States) will be restricted from account opening.

- On completing the KYC, the account will be converted to Savings Classic variant with Average monthly balance requirement of ₹10000 and its T & C will be applicable.

- Insta Savings Account will remain active only for 12 months from date of account opening.

- The aggregate balance of all the deposit accounts of the customer shall not exceed ₹95,000. In case the balance exceeds the threshold, the account shall cease to be operational, till full KYC is completed.

- The aggregate of all credits in a financial year, in all the deposit accounts taken together, cannot exceed ₹2,00,000.

- Vouchers offered under the promotional offers may change from time to time and are governed by their own terms and conditions.

Need Help?

Get in touch with our Smile Centre

Frequently Asked Questions

When will the customer receive the voucher?

Which debit card variant will the customer get?

Can full KYC be completed at any branch, or must it be done only by visiting the base branch?

Can a customer complete the full KYC on the same day or the very next day?

How long a customer can access account without full KYC?

After full KYC, in which variant the account will be converted to?

What is the maximum amount allowed in the account?

What will happen if the account is not funded?

Explore Other Special Account

Blossom Women Savings Account

Average monthly balance

₹10,000

Interest rate of upto

7.75%* p.a.

Daily ATM withdrawal limit

₹40,000

Next Gen Savings Account

Average monthly balance

Zero

Interest rate of upto

3%* p.a.

Daily ATM withdrawal limit

₹3,000

Share Your Smile Savings Account

Average monthly balance

Zero

Donate to causes

Maximum 2

Tax Exemption under 80G of IT

50%

Bank with us your way

Banking at Fingertips

Fast, easy & secure banking

Anywhere, anytime banking

Cashless banking

Version : -11.0

SHA256 : -b56d2ed4c843275b89307d431c284c0401253af6d3c7d9040ebf2beb1c1e952b

SHA1 : -efd2c45d95d84b15858d8a573fdcc9d2d259c9df

Version : -11.0

iOS user cannot install application other than the app store. We upload archive file which gets converted to ipa after upload to app store. Checksum of ipa and archive will never be same so checksum will not be applicable for iOS binary.

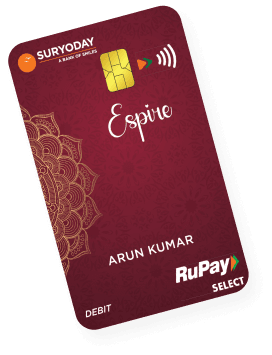

Espire Premium Banking

An exclusive curation of banking and lifestyle privileges to match your class, ambition and aspiration.

Explore. Discover. Learn

Celebrate Our Special Offers

Exciting rewards ready to delight you

Interest Rates

Feedback

About us

About us

Products & Services

Products & Services

Ways to bank

Ways to bank

Rate of Interest

Rate of Interest

Schedule of charges

Schedule of charges

Forms Center

Forms Center

Resources

Resources

Careers

Careers

Smile center

Smile center

Investor relations

Investor relations

Miscellaneous

Miscellaneous

© 2025 Suryoday Small Finance Bank Limited

Apply for Savings Account | Book Fixed Deposit (for New Customers) | Book Fixed Deposit (for Existing Customers) | Apply for Home Loan | Apply for Loan Against Property | Apply for Current Account

Please notify any unauthorized transaction on 1800 266 7711 or email at smile@suryodaybank.com immediately. Do not share OTP, PIN or any other sensitive banking details.

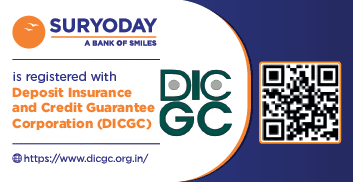

*Interest rates are subject to change. T&C Apply. DICGC insurance cover applicable.