Your smile speaks

Know More About Salary Savings Account Standard

Let your salary grow at an attractive interest rate as you enjoy monthly interest pay-out. Enjoy the flexibility of zero balance Salary Savings Account Standard and save more with exciting debit card offers.

More Reason To Choose Salary Savings Account Standard

AMB Requirement

Zero Balance

Interest Rates

Up to 7.75%* p.a. with monthly interest credit

Online Banking

Fund transfers, bill payments, debit card payments and more

Safe & Secure Transactions

Fast, convenient, and secure banking experience

Rates & Charges

Average monthly balance

₹0

FD amount in place of AMB

₹0

Minimum initial payment amount

₹0

Eligibility and documents

Who can apply?

Applicant needs to be employed with a corporate that has a salary account relationship with us.

What are the documents required?

Open Account in 3 Steps

Fill in your personal details

Authenticate your Aadhaar

Complete your KYC

Terms and Conditions

- Taxes as applicable will be levied on the charges.

- Earn 2.50%* p.a. on balance up to and including ₹1 Lakh.

- 4.00%* p.a. on balance over ₹1 Lakh up to and including ₹5 Lakh.

- 7.25%* p.a. on balance over ₹5 Lakh up to and including ₹10 Lakh.

- 7.50%* p.a. on balance over ₹10 Lakh up to and including ₹2 Crore.

- 7.50%* on balance over ₹2 Crore up to and including ₹5 Crore.

- 7.75%* p.a. on balance over ₹5 Crore up to and including ₹25 Crore.

- 7.25%* p.a. on balance over ₹25 Crore.

- Applicable interest will be calculated on the incremental amount for the slabs. Rates are subject to change from time to time at the sole discretion of Suryoday Small Finance Bank Ltd.

*T&C Apply.

Need Help?

Get in touch with our Smile Centre

Frequently Asked Questions

What is AMB requirement of Salary Savings Account Standard?

Will I get a Debit Card with Salary Savings Account Standard?

What is Daily ATM withdrawal limit of Salary Savings Account Standard?

What is Daily POS usage limit – Value of transaction with Salary Savings Account Standard?

What is Daily POS usage with Salary Savings Account Standard?

What are exclusive features of Salary Savings Account Standard?

Explore Other Salary Savings Account

Salary Savings Account Premium

Interest rate of upto

7.75%* p.a.

Daily ATM withdrawal limit

₹1,00,000

Daily POS usage limit

₹1,00,000

Bank with us your way

Banking at Fingertips

Fast, easy & secure banking

Anywhere, anytime banking

Cashless banking

Version : -11.0

SHA256 : -b56d2ed4c843275b89307d431c284c0401253af6d3c7d9040ebf2beb1c1e952b

SHA1 : -efd2c45d95d84b15858d8a573fdcc9d2d259c9df

Version : -11.0

iOS user cannot install application other than the app store. We upload archive file which gets converted to ipa after upload to app store. Checksum of ipa and archive will never be same so checksum will not be applicable for iOS binary.

Espire Premium Banking

An exclusive curation of banking and lifestyle privileges to match your class, ambition and aspiration.

Explore. Discover. Learn

Celebrate Our Special Offers

Exciting rewards ready to delight you

Interest Rates

Feedback

About us

About us

Products & Services

Products & Services

Ways to bank

Ways to bank

Rate of Interest

Rate of Interest

Schedule of charges

Schedule of charges

Forms Center

Forms Center

Resources

Resources

Careers

Careers

Smile center

Smile center

Investor relations

Investor relations

Miscellaneous

Miscellaneous

© 2025 Suryoday Small Finance Bank Limited

Apply for Savings Account | Book Fixed Deposit (for New Customers) | Book Fixed Deposit (for Existing Customers) | Apply for Home Loan | Apply for Loan Against Property | Apply for Current Account

Please notify any unauthorized transaction on 1800 266 7711 or email at smile@suryodaybank.com immediately. Do not share OTP, PIN or any other sensitive banking details.

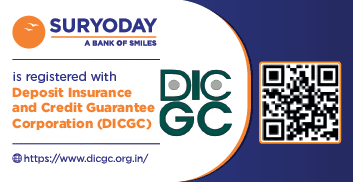

*Interest rates are subject to change. T&C Apply. DICGC insurance cover applicable.