Your smile speaks

Know More About Espire Lite

A fascinating bouquet of banking benefits and lifestyle delights that are not just curated to enhance your everyday life, but to make you feel truly special. With Espire Lite, get ready to elevate your banking experience and add a touch of indulgence to your lifestyle.

More Reasons To Choose Espire Lite

Exclusive Offers

Save more as you spend

Interest Rate

Upto 7.75%* p.a. with monthly interest credit

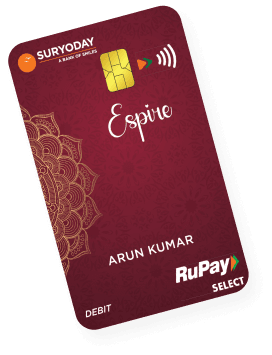

Select* Debit Card

Year-round offers on spendings

Family Banking

Extend the privileges to your family

Rates & Charges

Average Monthly Balance

₹7,50,000 per month OR ₹1,00,000 per month with TRV* of ₹30,00,000

FD amount in place of AMB

₹30,00,000

Specially designed RuPay International Debit Card

- ATM withdrawal limit of ₹2,50,000 per day

- Unlimited free transactions on other bank ATMs in India

- POS Usage Limit of ₹5,00,000 per day

- Year-round offers across categories: Lounge Access, Insurance, Concierge Services, Golf, GYM, Health, OTT and Spa Services

- Family Banking: Upto 4 family members can enjoy benefits of RuPay Select Debit card

Eligibility And Documents

Who can apply?

Resident individual (single or joint Holders)

Hindu undivided family

Minor under appointed guardian

What are the documents required?

Open Account in 3 Steps

Fill in your personal details

Authenticate your Aadhaar

Complete your KYC

Terms and Conditions

- Taxes as applicable will be levied on the charges.

- Earn 2.50%* p.a. on balance up to and including ₹1 Lakh.

- 4.00%* p.a. on balance over ₹1 Lakh up to and including ₹5 Lakh.

- 7.25%* p.a. on balance over ₹5 Lakh up to and including ₹10 Lakh.

- 7.50%* p.a. on balance over ₹10 Lakh up to and including ₹2 Crore.

- 7.50%* on balance over ₹2 Crore up to and including ₹5 Crore.

- 7.75%* p.a. on balance over ₹5 Crore up to and including ₹25 Crore.

- 7.25%* p.a. on balance over ₹25 Crore.

- Applicable interest will be calculated on the incremental amount for the slabs. Rates are subject to change from time to time at the sole discretion of Suryoday Small Finance Bank Ltd.

*T&C Apply.

Need Help?

Get in touch with our Smile Centre

Frequently Asked Questions

How many members can avail Family Banking facility under Espire Lite?

Who can be included in Family Banking?

What is the AMB Requirement for Family Members to avail Family Banking?

Is RuPay Select Debit Card available for all members under Family Banking?

Are Espire Lite customers eligible for lifestyle benefits vouchers?

What are the benefits of RuPay International Select Secure Chip Debit Card?

What is the dedicated contact number for Espire Premium Banking?

Explore Other Espire Accounts

Espire Arise

Average Monthly Balance

₹7,50,000

Interest rate of upto

7.75%* p.a.

Daily ATM withdrawal limit

₹2,50,000

Espire Supremis

Average Monthly Balance

₹10,00,000

Interest rate of upto

7.75%* p.a.

Daily ATM withdrawal limit

₹3,00,000

Espire Gloria

Average Monthly Balance

₹25,00,000

Interest rate of upto

7.75%* p.a.

Daily ATM withdrawal limit

₹5,00,000

Interest Rates

Feedback

About us

About us

Products & Services

Products & Services

Ways to bank

Ways to bank

Rate of Interest

Rate of Interest

Schedule of charges

Schedule of charges

Forms Center

Forms Center

Resources

Resources

Careers

Careers

Smile center

Smile center

Investor relations

Investor relations

Miscellaneous

Miscellaneous

© 2025 Suryoday Small Finance Bank Limited

Apply for Savings Account | Book Fixed Deposit (for New Customers) | Book Fixed Deposit (for Existing Customers) | Apply for Home Loan | Apply for Loan Against Property | Apply for Current Account

Please notify any unauthorized transaction on 1800 266 7711 or email at smile@suryodaybank.com immediately. Do not share OTP, PIN or any other sensitive banking details.

*Interest rates are subject to change. T&C Apply. DICGC insurance cover applicable.