Your smile speaks

Know More About Pradhan Mantri Jeevan Jyoti Bima Yojana

Secure your family’s dreams with Pradhan Mantri Jeevan Jyoti Bima Yojana, a social security scheme by the Government of India. Get a term life insurance plan with a Sum Assured of ₹2 Lakh for an affordable annual premium of ₹436.

More Reasons To Pradhan Mantri Jeevan Jyoti Bima Yojana

Online Application

Choose to apply conveniently with paperless process

Applicant’s Age Eligibility

18 to 50 years

Auto-debit facility

Don’t miss paying the annual premium of ₹436

Safe & Secure Transactions

Fast, convenient, and secure banking experience

Eligibility and documents

Who can apply?

SSFB Savings Bank Account holders between 18 years (completed) and 50 years (age nearer birthday) who consent to join the scheme / enable auto-debit, as per the Scheme modality.

Minimum Age: 18 years

Maximum Age: 50 Years (Cover up till 55 years of age)

What are the documents required?

Apply For Pradhan Mantri Jeevan Jyoti Bima Yojana In 3 Steps

Fill in your personal details

Authenticate your Aadhaar

Complete your KYC

Terms and Conditions

- If a customer is having multiple Savings Account with the Bank, then only one PMJJBY policy will be issued.

- The risk cover will commence only after completion of 45 days from the scheme enrolment date by the customer. Death due to accident is exempt from the 45 days cooling period.

- Customer is liable to pay full annual premium even if he/she join the Scheme after the commencement of the Master Policy.

- Renewal Premium of ₹436 is auto debited from the savings account between 20th June and 30th June of every year. Customers who desire to cancel the auto renewal need to submit such request to the nearest branch before 20th June. Renewal premium is debited until the eligible age of the insured as per the scheme details.

- Suicide is not covered under the policy.

Need Help?

Get in touch with our Smile Centre

Frequently Asked Questions

What is Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)?

Who is eligible for PMJJBY?

What is the coverage amount under PMJJBY?

What is the premium for PMJJBY?

How to enroll in PMJJBY?

Can I enroll in PMJJBY online?

What is the policy period and renewal process?

What happens if the policyholder dies?

Can I have multiple PMJJBY policies?

Is there a waiting period for claims?

What if I miss paying the premium?

Can NRIs enroll in PMJJBY?

Can I exit the scheme?

What is the difference between PMJJBY and PMSBY?

Is PMJJBY taxable?

How to check PMJJBY status?

What if I change my bank account?

Who are the insurers under PMJJBY?

What if I am already covered under another life insurance policy?

Where can I get more details?

Explore All Social Security Schemes

Atal Pension Yojana

Guaranteed Pension

From ₹1000 to ₹5000

Applicant Age

18 – 40 years

Pension will start at age

60 years

Pradhan Mantri Jeevan Jyoti Bima Yojana

Premium (per annum)

₹436

Applicant Age

Min 18 years Max 50 Years

Cover up till age of

55 years

Pradhan Mantri Suraksha Bima Yojana

Premium (per annum)

₹20

Applicant Age

Min 18 years

Applicant Age

Max 70 Years

Bank with us your way

Banking at Fingertips

Fast, easy & secure banking

Anywhere, anytime banking

Cashless banking

Version : -11.0

SHA256 : -b56d2ed4c843275b89307d431c284c0401253af6d3c7d9040ebf2beb1c1e952b

SHA1 : -efd2c45d95d84b15858d8a573fdcc9d2d259c9df

Version : -11.0

iOS user cannot install application other than the app store. We upload archive file which gets converted to ipa after upload to app store. Checksum of ipa and archive will never be same so checksum will not be applicable for iOS binary.

Espire Premium Banking

An exclusive curation of banking and lifestyle privileges to match your class, ambition and aspiration.

Explore. Discover. Learn

Celebrate Our Special Offers

Exciting rewards ready to delight you

Interest Rates

Feedback

About us

About us

Products & Services

Products & Services

Ways to bank

Ways to bank

Rate of Interest

Rate of Interest

Schedule of charges

Schedule of charges

Forms Center

Forms Center

Resources

Resources

Careers

Careers

Smile center

Smile center

Investor relations

Investor relations

Miscellaneous

Miscellaneous

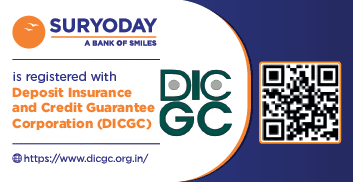

© 2025 Suryoday Small Finance Bank Limited

Apply for Savings Account | Book Fixed Deposit (for New Customers) | Book Fixed Deposit (for Existing Customers) | Apply for Home Loan | Apply for Loan Against Property | Apply for Current Account

Please notify any unauthorized transaction on 1800 266 7711 or email at smile@suryodaybank.com immediately. Do not share OTP, PIN or any other sensitive banking details.

*Interest rates are subject to change. T&C Apply. DICGC insurance cover applicable.