#Banking

#Technology

All you need to know about UPI Fraud

- 12 Jun, 2024

- 2 Mins Read

Most wide-spread UPI Frauds:

- Fake UPI money request: One of the common methods used by scammers is by sending money to the victim's UPI account and then making a phone call pretending that the transfer was a mistake. In such cases, the scammers call the victim in urgency and ask them to return their money. They further provide a UPI link (fake or malicious link) to the victim to initiate the refund process. And as soon as the victim clicks on the link, they unknowingly grant the scammer remote access to their phone or digital wallet and bank account, allowing the fraudster to hack and steal their money

- Fake QR codes: The scammers tell targeted people that they will send them their money using a QR code. But when the victim scans the QR code, they are prompted to enter their UPI PIN. And as soon as they enter the PIN, the money gets deducted from the victim's account instead of the scammers

- Fake Identity: Investigations reveal that scammer generally follow a pattern to execute hacking. Scammer call their targets by disguising themselves as bank employees to make the whole process more reliable to the users. They ask for basic information such as birthday, name, address etc. They ask to share any bank or UPI app-related issues. As you mistakenly trust them and share your issues, they will ask to share your data. They will also ask you to download any app that will scan every data from your phone. Scammers will send a 9-digit code to users. Upon providing the 9-digit code, scammers will get full access to users’ UPI application and bank account.

Savings Ujjwal

Enjoy interest rate of upto 7.75%*

Monthly pay-out of interest in the account

Exciting Rupay debit card offers

How can you protect yourself?

To avoid harmful intrusion into your UPI account, you can follow the below-mentioned tips -

- Enter UPI PIN ONLY on the app’s UPI PIN page. Do NOT share UPI PIN with anyone.

- Enter UPI PIN ONLY to pay money from your account. UPI PIN is NOT required for receiving money.

- Check the receiver's name on verifying the UPI ID. Do NOT pay without verification.

- Do not share any of your bank details with anyone, even if they say they are as a bank employee. Remember Suryoday Small Finance Bank will never ask for your sensitive banking details

- Report any unauthorised debit as soon as you notice it.

- Try to get customer service numbers from official sites only.

- Do not download any screen sharing or SMS forwarding apps when asked upon by any unknown person and without understanding its utility.

- Be sceptical of unexpected money transfers. Be very careful with payment requests.

- Do not click on spam links. Avoid unauthorised shopping sites.

- Scan QR Code only for making payment and not for receiving money.

We hope this guide on UPI frauds helps to potentially identify and avoid the issues of getting scammed. We wish you a safe banking experience with Suryoday Small Finance Bank

Bank with us your way

Banking at Fingertips

Fast, easy & secure banking

Anywhere, anytime banking

Cashless banking

Version : -11.0

SHA256 : -b56d2ed4c843275b89307d431c284c0401253af6d3c7d9040ebf2beb1c1e952b

SHA1 : -efd2c45d95d84b15858d8a573fdcc9d2d259c9df

Version : -11.0

iOS user cannot install application other than the app store. We upload archive file which gets converted to ipa after upload to app store. Checksum of ipa and archive will never be same so checksum will not be applicable for iOS binary.

We Always put you first

We, at Suryoday Bank, are proud to have served over 2.8 million satisfied customers and enabled them, in their pursuit of financial security and prosperity, to achieve a brighter financial future.

Espire Premium Banking

An exclusive curation of banking and lifestyle privileges to match your class, ambition and aspiration.

Need Help?

Get in touch with our Smile Centre

Our Strong Smiling Family

At Suryoday, we foster a positive workplace culture with employee initiatives that inspire, empower and celebrate our team's growth and well-being.

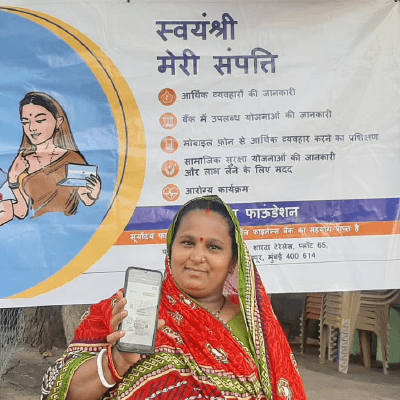

Our CSR Initiatives

Spandan

A Preventive Health Program

For Women & Children

Explore. Discover. Learn

Celebrate Our Special Offers

Exciting rewards ready to delight you

Interest Rates

Feedback

About us

About us

Products & Services

Products & Services

Ways to bank

Ways to bank

Rate of Interest

Rate of Interest

Schedule of charges

Schedule of charges

Forms Center

Forms Center

Resources

Resources

Careers

Careers

Smile center

Smile center

Investor relations

Investor relations

Miscellaneous

Miscellaneous

© 2025 Suryoday Small Finance Bank Limited

Apply for Savings Account | Book Fixed Deposit (for New Customers) | Book Fixed Deposit (for Existing Customers) | Apply for Home Loan | Apply for Loan Against Property | Apply for Current Account

Please notify any unauthorized transaction on 1800 266 7711 or email at smile@suryodaybank.com immediately. Do not share OTP, PIN or any other sensitive banking details.

*Interest rates are subject to change. T&C Apply. DICGC insurance cover applicable.